IN THE SPOTLIGHT: Mr. Market triplets

Dad and kids put together a board game

A new finance board game for families, “Mr. Market,” is the creation of a family of longtime Boca Grande regulars. The Jack White family connected to Boca Grande through Jack’s father’s friends from Stetson Law School and started visiting the area more than four decades ago. “One of his law buddies brought him over because they were both into fishing,” White said. “We started coming here when I was little.”

Over the decades, their visits became more frequent. One year, they fished on Mark Futch’s team, and won on the World’s Richest. After that, his parents decided to make Boca Grande a second home. They eventually bought a condo. A 1996 win on Capt. Marty Scott’s Little Car Man got him a spot on the cover of the Beacon for the Tarpon Tide 109 pounder.

Jack and his wife, Kelly, have homeschooled triplet daughters, Mae, Sarah and Claire, and spend a month in Boca Grande each spring, though they are in Daytona the rest of the year. “We stay at the Silver King; we rent it for May. It’s the perfect time for us,” White said.

Jack’s interest in investing began as an undergraduate at Stetson University, where he enrolled in the Roland George Investments Program. It’s a student-led portfolio management program where business students manage a real $6 million portfolio.

“The students get to manage real money,” he said. They used the Buffett method, picking stocks based on Warren Buffett’s investment principles.

“What a great experience, and a way to take you to the street as opposed to just staying in the classroom,” White said. After graduation, White pursued a career in real estate investing. Still, he often thought about how valuable the program had been for his education, calling it a “dire need” for all levels of learning. That idea returned to him when he considered his daughters’ education.

“We homeschool our daughters, which is how we got into this game,” White said.

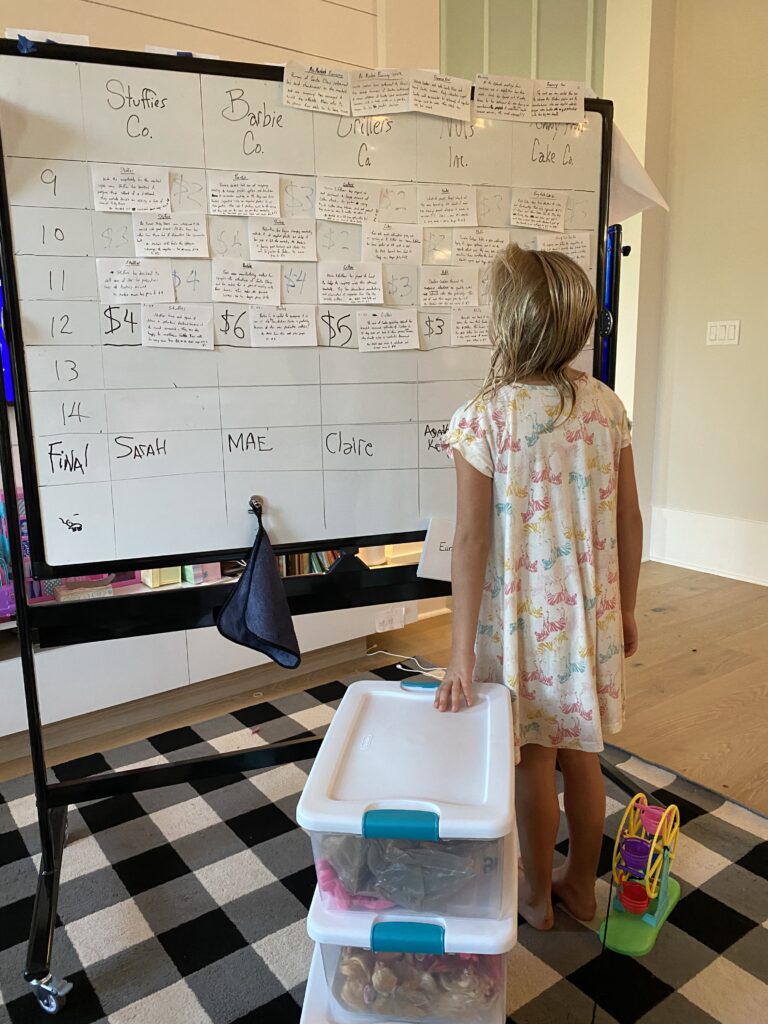

The investing game they created is a classic board game, but instead of dice and a path like Life or Monopoly, players pick cards and invest in a set of companies on a board “grid” of funding rounds. With his daughters, he developed the game based on lessons from the Stetson program.

There are other financial games, including a Dave Ramsey finances and budgeting game, but White found those were not appealing to kids, especially those who hadn’t yet made financial mistakes. Instead, he thought a game with the appeal of trading cards might be more appropriate.

The initial game set includes company cards relatable to kids, such as Stuffies (a teddy bear maker), Gnarly Nuts (a snack brand), and Funny Fruit (a dried fruit company). There are also Economy cards that influence the broader game. Each session includes a “Chronicle” newspaper, which provides background on the companies and the game’s overall economy. “If you try to play the market, you’re gambling,” White said. “You’re buying the company, not the stock.”

They didn’t pitch the idea to another company. In today’s startup environment, White said, you need a proof of concept before gaining serious interest. They tested the game with a large group of kids through a “Gamify” program. “It’s hard to pitch an idea,” White said. “Until you really get out there and figure out how it works, I’d rather just start doing it.”

Production on the game officially began in 2023 after the family tested several versions at home. The first prototype would have cost $250 to produce. A buying trip to Atlanta revealed that they needed to lower that to $50, the top price point for most board games. They solicited bids from vendors to determine if the game could be manufactured and shipped profitably at that price.

“The girls were all part of that process,” White said.

They began selling the game in November. By Christmas, they had sold about 300 units. They’re currently working to list the product on Amazon. One of their best customers so far has been a local financial advisor who purchased the games in bulk to give away as gifts – an alternative to the usual bottle of wine. “You’re building generational wealth,” White said. “You’re teaching legacy.”

The game is now available in a few retail stores, including one in the Black Mountain area of North Carolina and The Tide in Boca Grande. It is sold online at mrmarket.store.

“We are doing a lot of different things,” White said. Their next step: releasing expansion packs featuring five new companies and an ongoing storyline, similar to the way that comic-book makers release new versions.

One of White’s key goals is to connect Main Street and Wall Street, to make the market feel tangible and accessible to youth, rather than abstract. “It will be ingrained in them early on,” he said. Beyond the game, White is passionate about teaching kids about money, work and investing.

“I look at what they’re capable of,” he said. “We started a children’s business fair we do once a year. The children have to direct every step of the process.”

As part of their homeschooling, the family holds a regular finance class. White follows the Gradual Release of Responsibility model in their learning. It follows a sequence:

I do, you watch. I do, you help.You do, I help. You do, I watch.

“It’s evolving right now,” White said. “We are learning by doing, where it becomes more ingrained.”

Each of the triplets approaches business differently. The key lesson of the game, White says, is not to make emotional or impulsive decisions.

“As much as we try to raise them similarly, they all go down their own paths,” he said.

The girls are involved in every aspect of the business, from packing and mailing to acting as CEO. “It’s an opportunity to work with my daughters,” said White. “I tried to get them to go fishing.”